What factors should be taken into account to finalize the best tax software for 2024?

- The best tax software 2024 is designed to provide automated online preparation of individual as well as business taxes. There are free and paid versions that can be opted based on the complexity of the return. Tax Softwares must be chosen considering the complexity, budget, filing options, usefulness, features, and relevancy.

- Best Tax software for preparers must be easy to operate and understand. The laws must be explained in a simplified manner, and quick links to the IRS site or publications are always beneficial.

- Income tax return preparation becomes easier in tax software when software support is reliable and fast.

- Reputed tax software ensures fewer or no errors, more tax credits, and tax deductions that would help save more money.

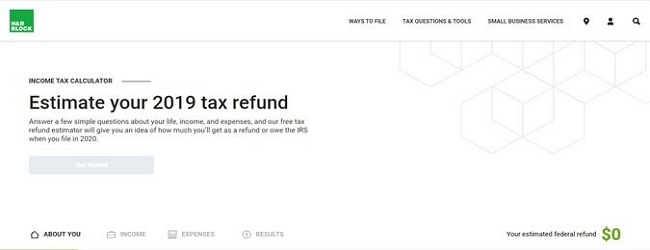

H&R Block

URL - https://www.hrblock.com/

H &R Block is a free version, takes care of pure or basic income from wages, income from bank interest dividends, child care expenses, social security income, retirement plan income, student loan interest concepts, and files schedules 1, 2, 3 properly. H&R block deluxe edition includes features of the free version plus itemized deductions, HAS distributions, consistent income, and credits.

Pricing:

- The free edition includes form W-2, kids, and education costs.

- Deluxe - $37.49+$44.99 per state.

- Premium online -$52.49+$44.99 per state.

- Self-employed online - $78.74+$44.99 per state.

Pros:

- It is suitable for filing simple and complex tax return filing.

- User-friendly and transparent navigation tool. Important topics are covered.

- The tax return review is done well.

Cons:

- Limitation of assistance and help virtually.

Best suited for:

- Free option, self-employed.

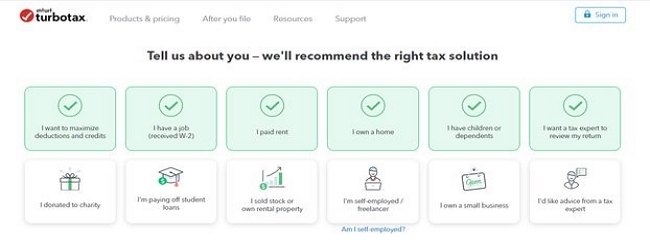

Intuit Turbo Tax

URL - https://turbotax.intuit.com/

This is the best tax software for small businesses. All tax forms, schedules, investments, and rental income calculation, home office deduction is provided by turbo tax. Turbo tax is one of the best choices for freelancers, CPAs, contractors, self-employed, etc. It is expensive but best for complex tax filers. Turbo Tax live provides live one on one CPA review and unlimited advice.

Pricing:

Software plan without live CPA support

- Free edition – Federal and state at $0.

- Deluxe edition - Federal $60 and state $50 per state.

- Premium – Federal @$90 and state $50 per state.

- Self-employed – Federal $120 and state @$50 per state.

Software plan with Live CPA support

- Basic starts @$80 and $45per state.

- Deluxe edition – Federal $120 and state $55 per state.

- Premium – Federal @$170 and state $55 per state.

- Self-employed – Federal @$200 and state @$55 per state.

Pros:

- They provide the best expert help through LIVE videos.

- All tax forms, schedules, and essential topics are explored.

- The support system has improved.

- 100% accuracy in calculation.

- Maximum refund is achieved.

Cons:

- Support help is sometimes given by non-intuit staff in online help.

Best suited for:

- Small businesses, simple to complex tax returns.

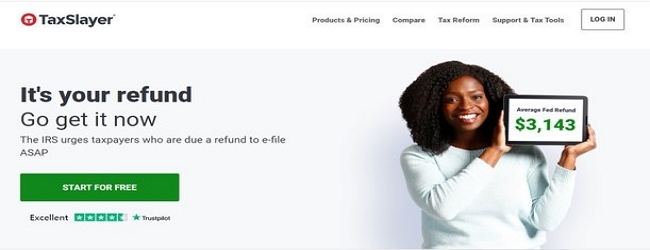

Tax Slayer

URL - https://www.taxslayer.com/

Tax return software is reasonable; the cheapest tax preparation system that comes with a smooth and user-friendly screen. It is suitable for mobile apps as well as the packages come with handling tax forms, schedules, itemized deduction, rental income, investments, self-employment tax return. The support is not up to mark. The queries have to be sent to “ask a tax pro” through tax slayer accounts. The service is provided on the phone or email.

Pricing:

- Federal and state returns are free in the free version.

- Federal - $17 in Classic, $37 in Premium, $47 in Self-employed.

- State - $39 per state in all the plans.

Pros:

- Guaranteed maximum refund and accuracy.

- Last year’s tax information can be derived.

- Very cheap with excellent support.

- The software has a good knowledge base.

Cons:

- Support on screen is less.

Best known for:

- Budget-friendly option.

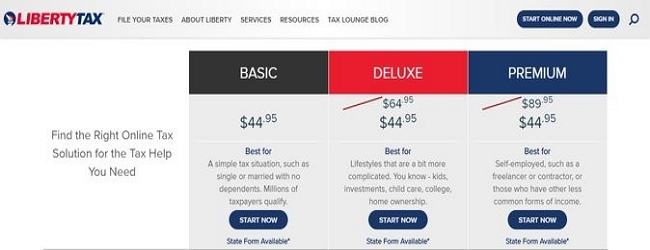

Liberty Tax

URL - https://videoconverter.wondershare.com/free-video-converter.html

This is the best tax software for self-employed for filing returns. Its charges are fairly more. It is good for beginners. This is not a right choice for simple tax returns calculations. Each plan has the same pricing for federal and state returns. The difference in each project is the availability of tax forms. Each program is designed considering the complexity of forms and schedules required. Those who want to file Form 1040, Schedule A, B, and Form 8853 opt for the basic plan. In addition to the basic idea, form 4562, 8829, 4136, 8839, 8853, Schedule C is filed in the deluxe plan. In addition to the deluxe program, Form 4684, 4835, and schedule E, F, K-1.

Pricing:

- Basic, Deluxe and Premium plans – Federal $44.95.

- $39.95 per state in basic and $34.95 in both deluxe and premium plans for the state return.

Pros:

- Double-checking system.

- It improved mobile compatibility.

- Audit assistance. 100% accuracy.

- Tax education tutorials.

- Great support system via email, chat.

Cons:

- It is expensive and has less context-sensitive support. State returns are costly.

Best for:

- Self-employed, Beginners.

Jackson Hewitt

URL - https://blog.media.io/images/top-list/jackson-hewitt.jpg

This is the best for tax prep from home for filing tax returns. The free version is beneficial for taxable income under $100,000. The premier plan is suitable for self-employed individuals, those having rental income, investment income. The grand plan is highly recommended for retirement income, families with kids, student loan interest.

Pricing:

- Deluxe's plan starts with $29.99 for federal and $36.99 per state.

- The premier plan starts with $49.99 for federal and $36.99 per state.

Pros:

- The mobile version is good.

- Errors are checked properly.

- Bookkeeping is performed in the background.

- Provides higher customer support.

- Higher security.

Cons:

- Expensive for simple returns.

- Lacks in searchable support and quality of context sensitivity.

Best for:

- Self-employed, complex returns

Summary

The best tax software for tax preparers must be user friendly with supportive help resources. Turbo tax is one such tax software that assists in complicated tax returns, whereas Jackson Hewitt is known for its responsive mobile service. The other three can be opted for after considering the return’s need.